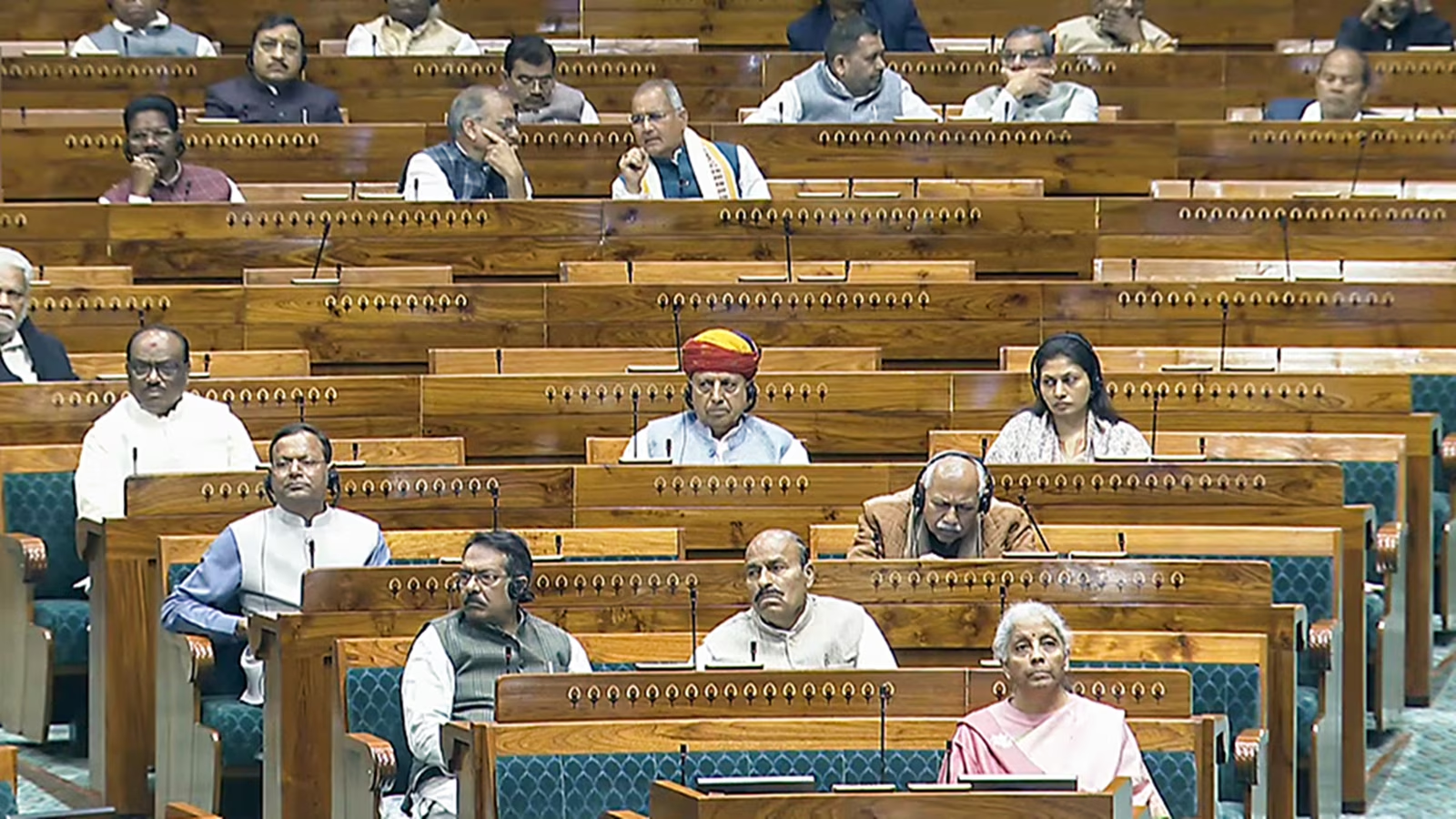

A day after tabling the Union Budget 2026–27, Finance Minister Nirmala Sitharaman on February 2 made it clear that economic growth remains the government’s overriding priority, even as it stays committed to fiscal consolidation, signalling more PSU divestment and asset monetization in the years ahead.

Speaking to reporters, Sitharaman said the government deliberately chose to protect capital expenditure and infrastructure spending, even though a steeper reduction in the fiscal deficit was feasible.

“Below 4.5% was my aim. I have reached 4.4% in FY26 and I am targeting 4.3% of GDP in FY27. We could have brought it down to 4%, but we are comfortable at 4.3% because growth is the priority,” she said.

Spending not compressed, assets being created

The Finance Minister underlined that fiscal consolidation has not come at the cost of spending cuts, stressing that the government is focused on lowering debt while continuing to build productive assets.

“We are looking at the debt-to-GDP ratio, but that doesn’t mean we are overlooking the fiscal deficit as a percentage of GDP. We are bringing it down while creating assets,” she said.

The Union Budget has shifted the fiscal anchor to the debt-to-GDP ratio, fixing the Centre’s target at 55.6% for FY27. Sitharaman added that while States do not yet follow a similar debt-based framework, the Centre would continue to “nudge” them towards fiscal discipline.

Disinvestment to ‘set the tone’ for revenues

Amid concerns over slower tax revenue growth and the future fiscal impact of the Eighth Pay Commission in FY28, Sitharaman said disinvestment and asset monetisation would play a key role in revenue generation.

“Asset monetisation will happen. We are also considering more public float from CPSEs. That doesn’t mean we will not focus on taxes—we need to widen the tax base. The revenue estimates for FY27 are realistic,” she said.

STT hike aimed at curbing speculation

Defending the hike in securities transaction tax (STT) on futures and options (F&O), Sitharaman said the move was intended to deter excessive speculative trading, particularly among retail investors.

“The F&O segment is highly speculative. I have received calls from parents saying their children are losing money and asking for intervention. The STT hike will act as a deterrent,” she said, ruling out any further changes beyond implementing the Budget proposal.

The Budget raised STT on futures to 0.05% from 0.02%, while STT on options premium and exercised options was increased to 0.15% from 0.1% and 0.125%, respectively. SEBI data shows that over 90% of retail investors lose money in F&O trading.

US tariffs not a factor, rupee watched closely

Addressing customs duty tweaks and incentives for labour-intensive sectors such as textiles, leather and footwear, Sitharaman said US tariffs did not influence Budget decisions.

“These changes have been happening in every Budget. They are part of a larger effort to help Indian citizens and businesses,” she said, adding that the government remains in close touch with the RBI on the rupee’s exchange rate.

‘Champion SMEs’ to scale up, not stay small

On the proposal to create “champion SMEs”, the Finance Minister said the focus would be on medium-sized enterprises, while ensuring smaller firms are not neglected.

“We cannot allow small enterprises to remain small. At the same time, medium enterprises fear becoming big because they think they will lose their advantages,” she said.

The message from North Block was unambiguous: growth will lead, fiscal discipline will follow—and divestment will help fund the journey.